• 19. 5. 2025 • H. T. •

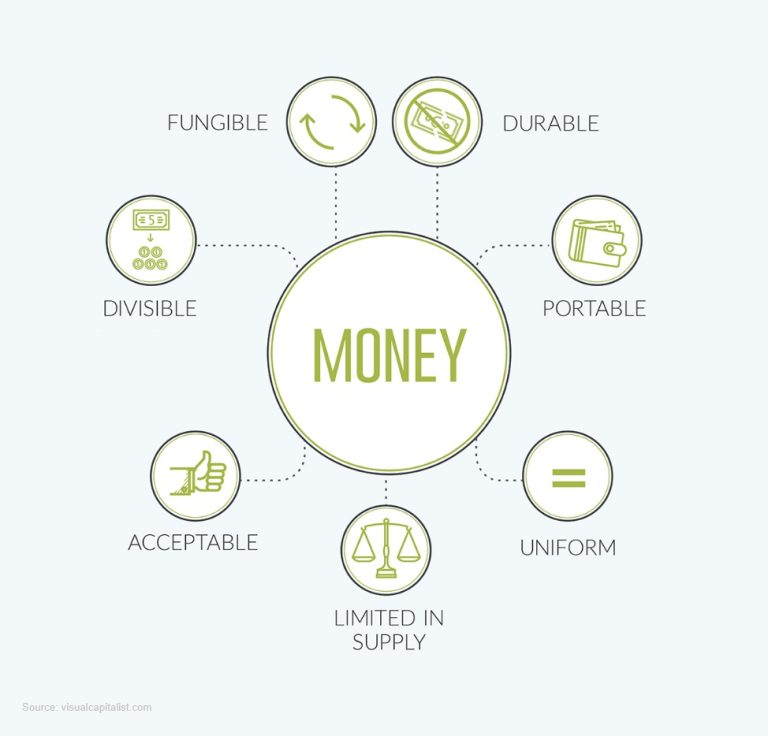

In the last article we took a look at 3 essential Functions of Money. In order to be most useful, money should hold certain properties that make it easy to exchange for goods and services and reduce transaction cost.

🔹 Durability – It must withstand the test of time and constant use. Imagine if your cash dissolved in rain! Wasn’t salt once used as money?

🔹 Portability – Easy to carry and transfer. Digital payments take this to the next level!

🔹 Divisibility – Can be split into smaller units to make transactions flexible. That’s why coins and cents exist (and decimals)!

🔹 Uniformity – Every unit is identical so people trust its value. No one wants a lopsided dollar bill!

🔹 Limited Supply – It must be scarce enough to maintain value. Too much money = inflation!

🔹 Fungibility – Each unit is interchangeable with another.

🔹 Acceptability – Everyone agrees it can be used for transactions. Without trust, money is just printed paper.

Since money represents one half of every transaction it shapes our lives in more ways than we realize!

How does a concept of honest, stable Money fulfill these properties in a digital age?