• 30. 12. 2024 • H. T. •

Ever wondered how commercial banks can make Currency out of thin air? The secret lies in the process of creating loans. Here’s a simple breakdown of how it works:

– When you deposit Currency in a bank you actually make a loan to the bank. It is now the Banks Currency. Your balance actually shows how much currency the bank owes you (it is not yours any more).

– When bank makes a loan, this is where the magic happens.

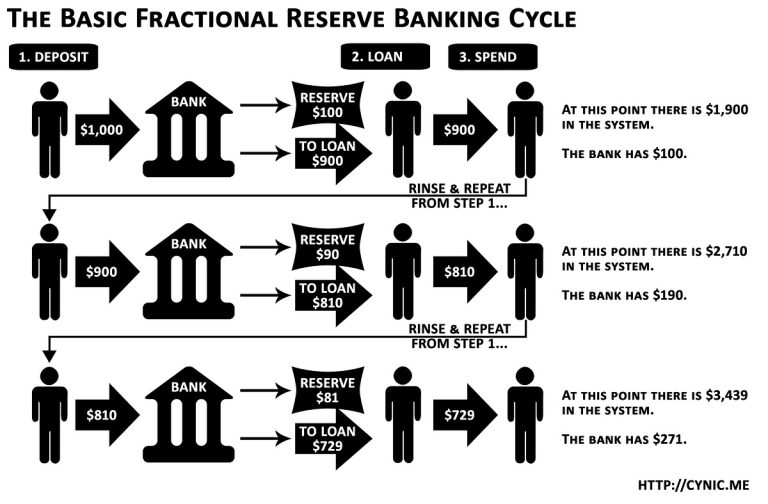

- Fractional Reserve Banking: Banks are required to keep only a fraction of their deposits as reserves. For example, if the reserve requirement could be 10% or less. The bank can ‘invest’ 90% or more, of your deposit.

- Creating Loans: When a bank approves a loan, it doesn’t physically move currecy from one account to another. Instead, it creates a new deposit account for the borrower, essentially creating new currency out of nothing.

- Interest Income: The bank charges interest on the loan, which becomes its profit. Over time, as borrowers repay the loan, the bank earns interest. So in fact they create profit for the currency they created out of thin air.

This process allows banks to multiply the amount of currency in the economy, known as the currency multiplier effect or infinite currency glitch. It can be a tool economic growth, if the loans are made for productive business investments. But this also comes with risks, such as financial instability if loans are made for speculative investments, such as stock market bubbles, realestate bubbles, …

Understanding how banks create currency helps us see the bigger picture of the financial system and its impact on our daily lives.