• 3. 1. 2025 • H. T. •

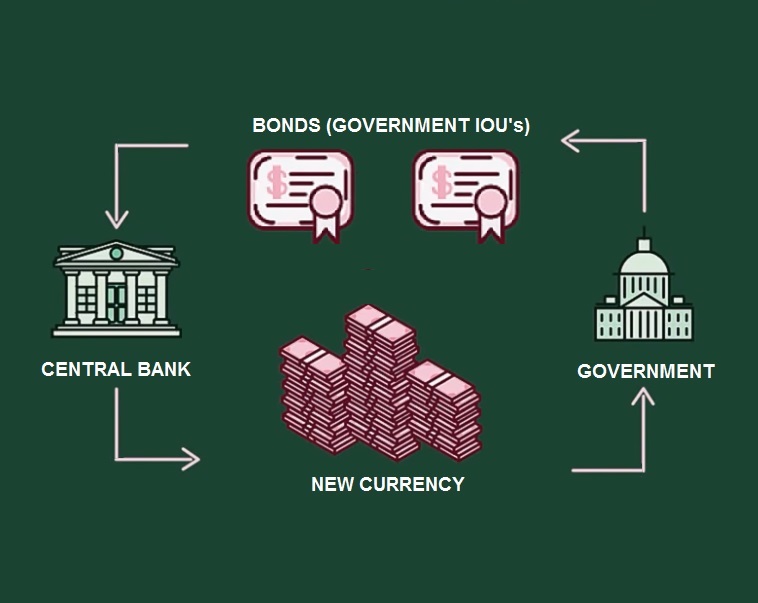

Ever wondered how the Central Banks can create money out of nothing? One of the key processes is called Debt Monetization (turning debt into Currency). Here’s a simple breakdown of how it works:

- Issuing Government Bonds: When the Government needs funds to cover its spending, it issues government bonds. These bonds are essentially IOUs that promise to pay back the borrowed money with interest.

- Buying Bonds: The Central Bank steps in and buys these Government Bonds from the open market. When the Central Bank purchases these bonds, it credits the sellers’ bank accounts with New Currency, effectively creating money out of thin air.

- Injecting Money into the Economy: The government can then use the funds from selling the bonds to finance its operations, such as public services, infrastructure projects, and social programs. The newly created Currency enters the economy, increasing the money supply – usiually causing inflation.

- Interest Payments: The Government pays interest on the bonds it issued. This interest is paid to the Bank and is usually funded by taxes we have to pay.

Debt monetization allows the Central Banks to create currency by “purchasing” Government debt.

Understanding how the Central Banks (like US Fed) create money through debt monetization helps us see the bigger picture of the financial system and its impact on our daily lives.