• 17. 11. 2025 • H. T. •

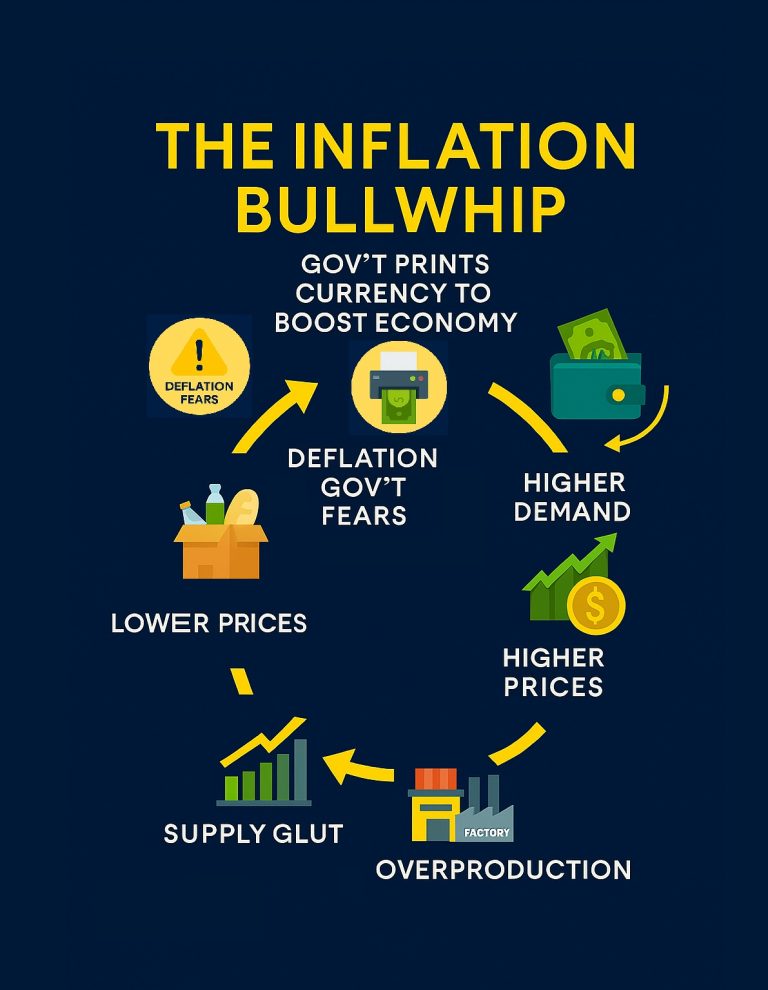

When governments print large amounts of currency, it doesn’t just raise prices — it amplifies volatility across the economy.

Here is the cycle:

- Currency Printing Begins Governments inject currency to stimulate demand — often during crises or slowdowns.

- Demand Surges Artificially Households and businesses spend more, even if real productivity hasn’t increased.

- Prices Rise More money chases the same goods → inflation kicks in.

- Producers Overreact Retailers and suppliers ramp up orders and production to meet perceived demand.

- Supply Glut Emerges Demand cools or normalizes → inventories pile up → prices start falling.

- Deflation Risk Appears Falling prices threaten profits, wages, and debt repayment. Governments panic.

- Currency Printing Resumes To avoid deflation, more stimulus is injected — restarting the loop.

Why It’s Dangerous

- Each cycle amplifies volatility: bigger booms, deeper busts.

- Inflation becomes sticky, while deflation risk never fully disappears.

- Central banks lose credibility.

- Households lose purchasing power.

- Real productivity gets distorted by artificial signals.

This is why Heperum matters: it has potential to break the loop by anchoring value in real productivity, and stabilize the economy by mitigating both inflation and deflation shocks.