• 3. 11. 2025 • H. T. •

Central banks should have been seen as guardians of price stability. Their job: to keep inflation in check, even if that meant raising interest rates and slowing growth. But what happens when governments pile up so much debt that raising rates becomes politically and financially impossible? That’s when a country slips into fiscal dominance.

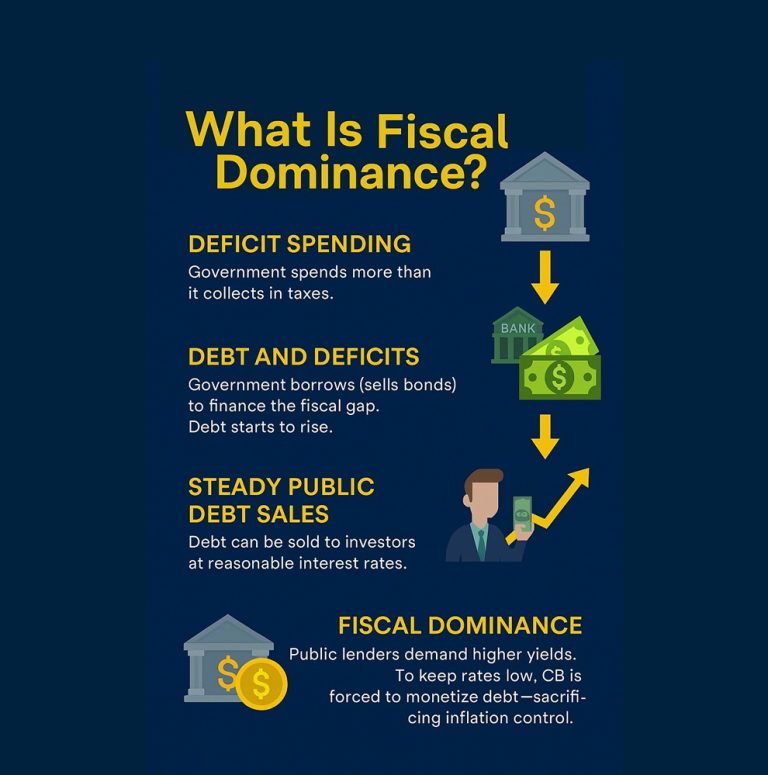

What Is Fiscal Dominance?

Fiscal dominance occurs when a government’s borrowing needs dictate central bank policy. Instead of focusing on inflation, the central bank is forced to keep interest rates low and buy government bonds to prevent a debt crisis.

How It Happens

- Persistent Deficits – Governments spend more than they collect in taxes, year after year.

- Rising Debt – To cover the gap, they issue bonds. Debt levels climb.

- Investor Pushback – As debt grows, investors demand higher yields to compensate for risk.

- Central Bank Dilemma – Raise rates to fight inflation and risk a fiscal crisis, or keep rates low and let inflation run.

- The Trap – Once the central bank chooses the second option, inflation control is sacrificed.

Why It Matters

- Inflation becomes entrenched.

- Currencies lose credibility.

- Citizens pay the hidden tax of rising prices.

- Economic stability erodes, even in advanced economies.

Japan is already living with fiscal dominance. The U.S., U.K., Italy, and France are edging closer as debt service costs explode.

A Way Forward

Fiscal dominance shows what happens when money serves debt instead of people. That’s why alternatives like Heperum matter. By anchoring value in productivity rather than politics, Heperum offers communities a way to preserve purchasing power even when national currencies are trapped in the debt spiral.