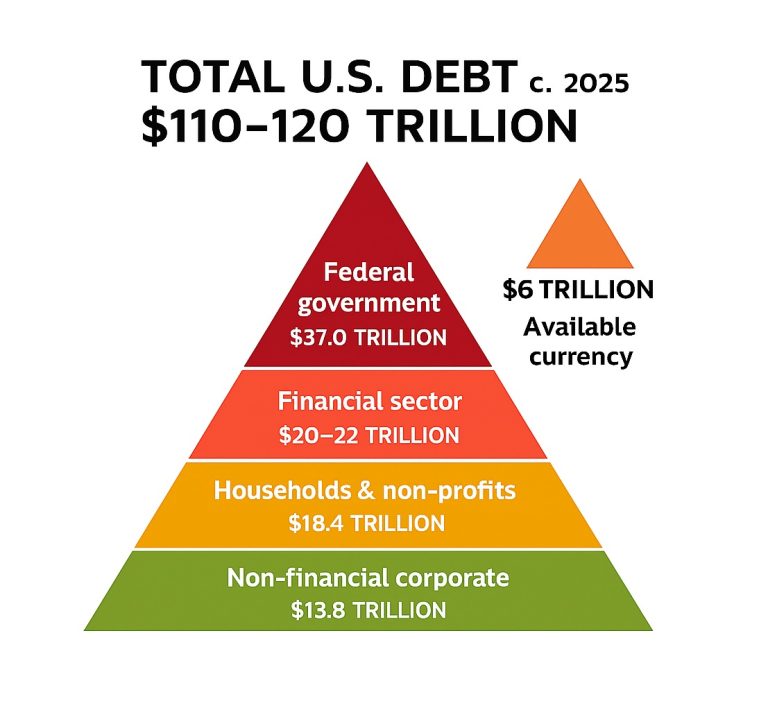

• 22. 9. 2025 • H. T. •$37 Trillion Federal Debt is just a Tip of the Iceberg. When you add state & local, household, corporate, and financial sector debt, the total climbs to $110–$120 trillion.

Here’s the breakdown:

- Federal government: ~$37 T

- State & local government debt – $3.5T (Includes states, counties, cities, school districts, etc.)

- Household debt – $18.4T (mortgages, credit cards, auto, student loans, etc.)

- Corporate debt – $13.8T (Bonds & loans issued by U.S. companies)

- Financial sector debt – $20–22T (banks, broker‑dealers, insurers, etc.)

- Other obligations – $15–25T

That’s how you can reach $110 T+ in total U.S. debt obligations, over 4x the size of the entire U.S. economy.

Perspective: That’s about $320,000 for every man, woman, and child in America.

Now here’s the kicker: The entire pool of base money — physical cash + bank reserves — is only about $6 trillion available for repayment of this debt.

That’s 5¢ of actual money for every $1 of debt. The rest? It exists only as credit entries in a system that depends on constant refinancing and expansion.

If just 20% of debts had to be repaid in cash tomorrow… the system would seize instantly.

How long until the pyramid topples? Is it time to consider some alternatives?