• 10. 2. 2025 • H. T. •

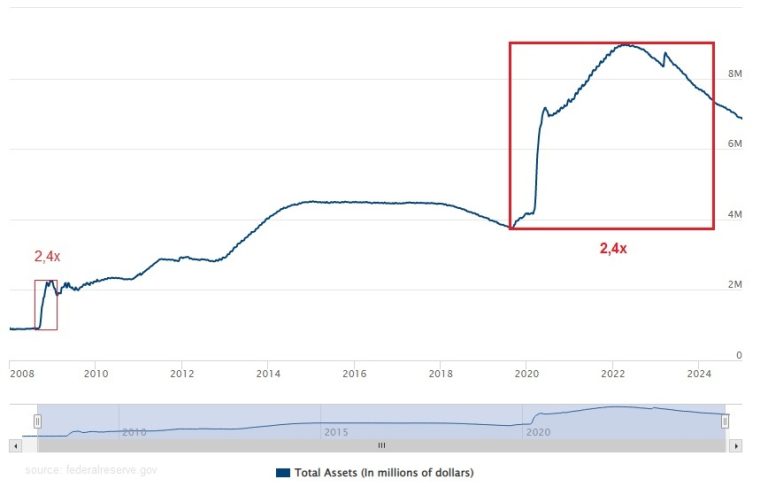

FED like other Central Banks has the ability to create Currency out of thin air by making purchases from the Government and other Institutions (like Banks). As of February 6, 2025, the Federal Reserve’s balance sheet stands at approximately $6.81 trillion. This includes a variety of assets such as Government Bonds, mortgage-backed securities and other assets. FED like other Central Banks has the ability to create currency out of thin air by making purchases from the Government and other Institutions (like Banks).

2008 Financial Crisis

During the 2008 financial crisis, the Federal Reserve’s balance sheet expanded from about $900 billion to $2.1 trillion. This was primarily due to the purchase of mortgage-backed securities and other assets to stabilize financial markets.

COVID-19 Crisis

During the COVID-19 pandemic, the Fed’s balance sheet grew from around $4 trillion to nearly $9 trillion by early 2022. This expansion was a result of large-scale asset purchases to support the economy during the pandemic.

Potential Future Crisis

Predicting the exact expansion of the Fed’s balance sheet in a future crisis is challenging, as it depends on the nature and severity of the crisis. However, based on past trends, it’s likely that the Fed would again engage in significant asset purchases. With the amount of leverage in the system the Currency printing will have to be unprecedented.

What are the consequences of such “interventions”? Inflation, Market distortions, asset bubbles, …