• 3. 2. 2025 • H. T. •

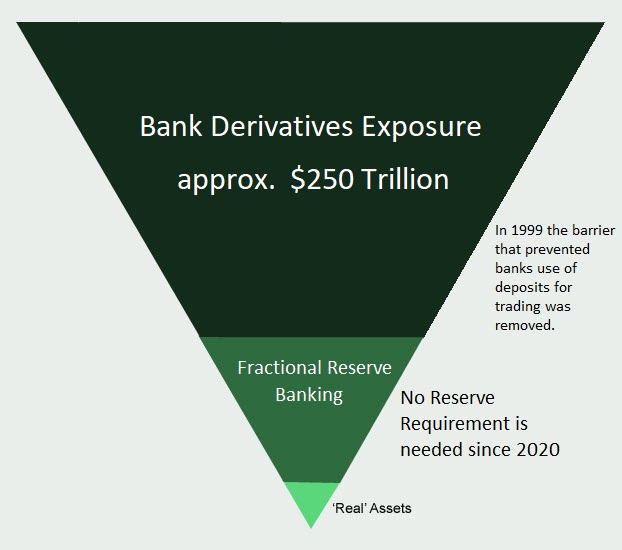

In 2020 the 10% reserve requirement for banks was canceled, so it is now 0. And 1999 the legislative barrier that prevented banks use of our deposits for trading & speculation was canceled.

This essentially means banks now don’t need to hold any assets to ‘print’ unlimited currency and use it to make massive speculative bets in derivatives market.

The result: Derivatives market has blown a galactic bubble. 9 of the largest (to big to fail) banks shown below hold a total of $248 Trillion of notional value of Derivatives > 2x of world economy. No government in world has money for this bailout:

- BNY Melon has a derivative exposure approx. $14 Trillion.

- State Street Financial has a derivative exposure approx. $14 Trillion.

- Wells Fargo has a derivative exposure approx. $14 Trillion.

- HSBC has a derivative exposure approx. $18 Trillion.

- Morgan Stanley has a derivative exposure approx. $23 Trillion.

- Bank of America has a derivative exposure approx. $25 Trillion

- Citibank has a derivative exposure approx. $28 Trillion

- Goldman Sachs has a derivative exposure approx. $54 Trillion

- JP Morgan Chase has a derivative exposure approx. $58 Trillion

To compare: In 2008 the Mortgage Backed Securities and Credit Default Swaps at were valued at approx. $70 Trillion. The exposure of banks is now 4 times bigger.

How much of this would be possible if we had sound, honest money, instead of currency created by a stoke of a keyboard?