• 20. 1. 2025 • H. T. •

Central Banks can create money out of nothing? One of the key processes is called Debt Monetization.

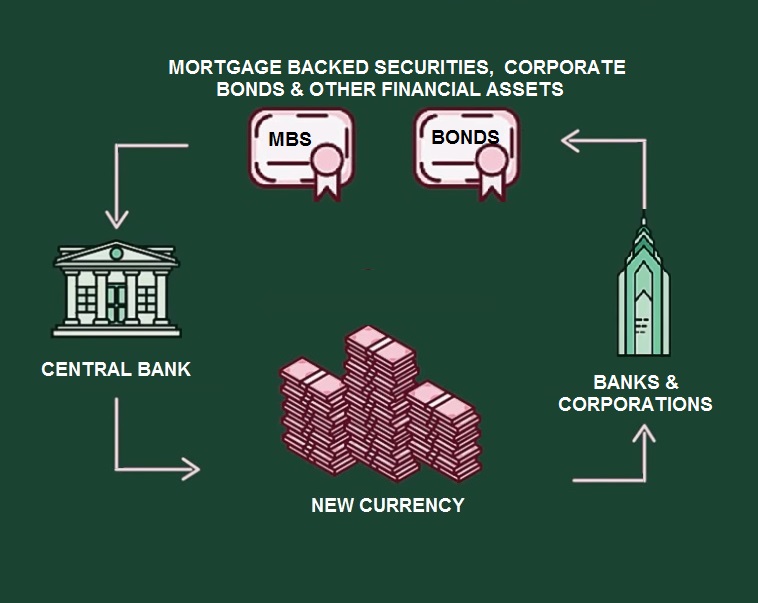

Another is Quantitative Easing (QE), here’s how it works:

- Buying Government and Non-Government Debt: Central bank buys debt from non-government institutions, such as mortgage-backed securities (MBS), corporate bonds and other financial assets. When the Central Bank purchases these securities, it credits the sellers’ bank accounts with new currency, effectively creating money out of nothing.

- Increasing Money Supply: By buying assets and securities, the Central Bank injects newly created currency into the economy. This increases the currency supply to encourage lending and spending, in hope to stimulate economic growth.

- Lowering Interest Rates: The increased demand for these securities pushes up their prices and lowers their yields (interest rates). Lower interest rates make borrowing cheaper for businesses and consumers.

- Inflate Asset Prices: QE results in higher asset prices, such as stocks and real estate, which can boost consumer and business confidence and spending, but often results ininflation.

Essentially QE means Central Banks purchase debt from non-govenrnment institutions to stimulate the economy. ‘Printing currency’ for QE comes with big risks, such as market distortions, asset bubbles (dotcom bubble, housing bubble) and inflation.